Every investor needs a back office.

Now you have one.

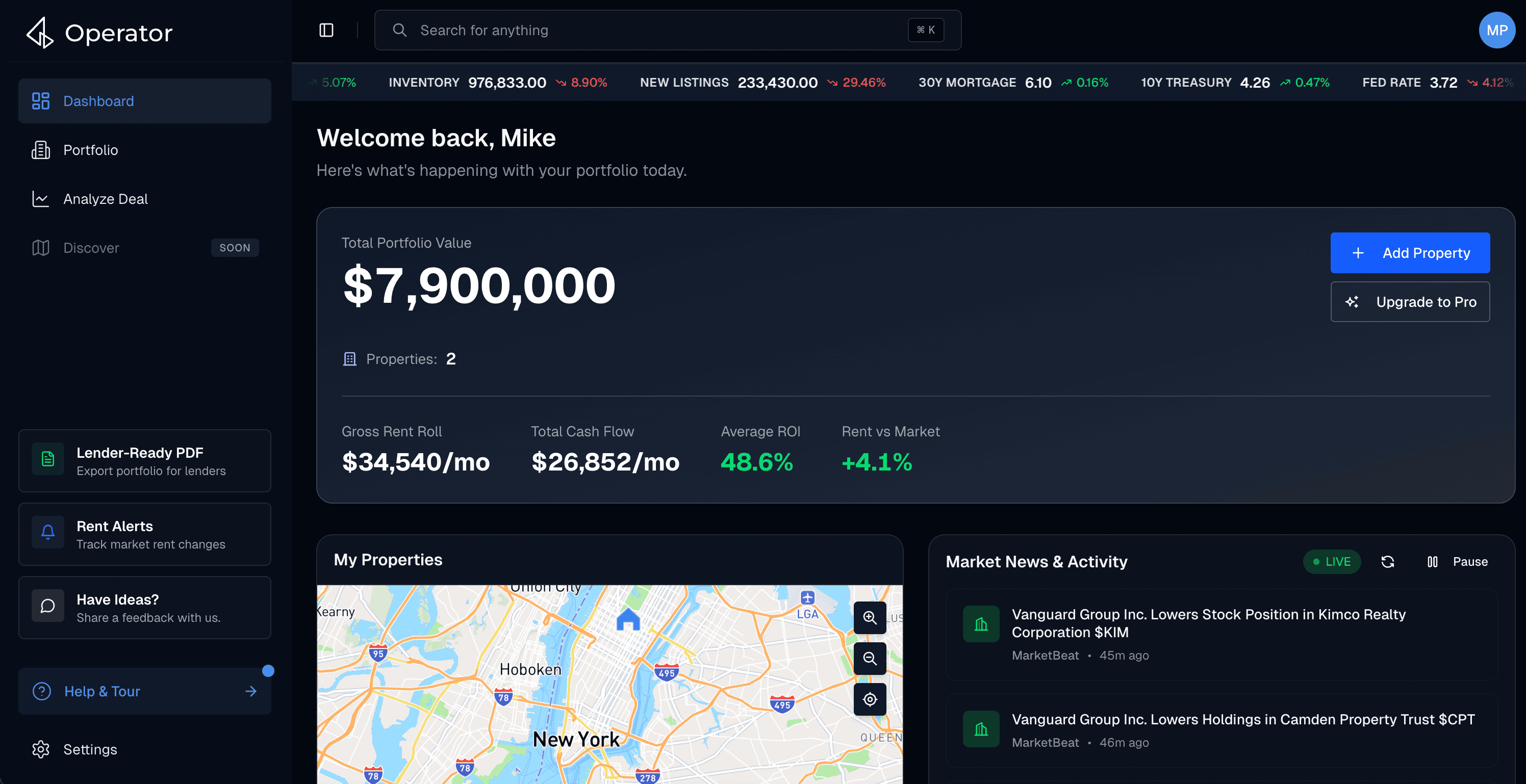

Portfolio tracking, market intelligence, deal analysis, and lender-ready reports — built for real estate investors who are scaling without a fund's infrastructure behind them.

Get Started FreeNo credit card. Free portfolio tracking forever.

As Featured In

2,400+

Properties tracked

$680M+

Portfolio value managed

48

States covered

12,000+

Rent comps analyzed

Built for investors, not spectators

You own rental property. Maybe a couple single-families, maybe a small multifamily, maybe both. You're buying, refinancing, running the numbers, trying to scale.

And you're tired of stitching together spreadsheets, Zillow screenshots, and whatever your CPA can tolerate.

You just want one place that shows you what's actually happening and what to do next. That's what we build.

Our Flagship Product

Operator

See how every deal shifts your returns.

Model acquisitions in real-time against your existing portfolio.

Test every assumption instantly.

Toggle rates, down payments, and terms — watch returns update live.

Never leave money on the table.

Automated tracking that finds below-market rents before you miss them.

You're probably undercharging on at least one unit.

The average Operator user finds about $1,800 per year in missed rent per unit.

We monitor every unit against live market comps and flag it when you're below market. Not months later when someone catches it. When it's happening.

Current Rent: $1,150/mo

Market Estimate: $1,400/mo

You're leaving $3,000/year on the table

Every deal changes the math.

Every other calculator evaluates deals in a vacuum. Operator shows you the real impact — cash flow, yield, leverage — against what you already own. Know before you make an offer whether this deal makes your portfolio stronger or just bigger.

Current Portfolio

IRR

14.2%

Cash-on-Cash

8.1%

Monthly Cash Flow

$8,200

With New Acquisition

IRR

12.4%

Cash-on-Cash

7.6%

Monthly Cash Flow

$9,800

Tools and Insights

Calculators

Analyze any deal in 60 seconds. Punch in an address, toggle your loan terms, and watch cash-on-cash, IRR, and monthly cash flow update live. Free. No account required.

Blog

Real deal breakdowns from active investors. Market analysis, acquisition playbooks, and the math behind real transactions — not theory.

What Operators Say.

The dashboard was the first thing I cared about. When I log into other tools, it's a bunch of stuff that doesn't really help me. With Operator, I see my entire portfolio live, in one place. That alone makes it worth it.

Jimmy M.

23 properties, Tennessee

Operator gives me the same kind of visibility I had in private equity. It honestly feels like a Bloomberg Terminal for rental properties.

Sarah M.

8 properties, California

I managed 11 properties in a spreadsheet for years. I moved everything into Operator in about 20 minutes and haven't opened that spreadsheet since.

David K.

12 properties, Arizona

I used to realize I was under market only after a tenant moved out and I checked comps. Now I get notified the moment there's a gap. I raised rents on three units last quarter and added about $400 a month without having to dig for the data.

Marcus T.

6 properties, Texas

Stop guessing, Start Operating.

Start free. Find out what you're missing in under 5 minutes.

Get Started Free